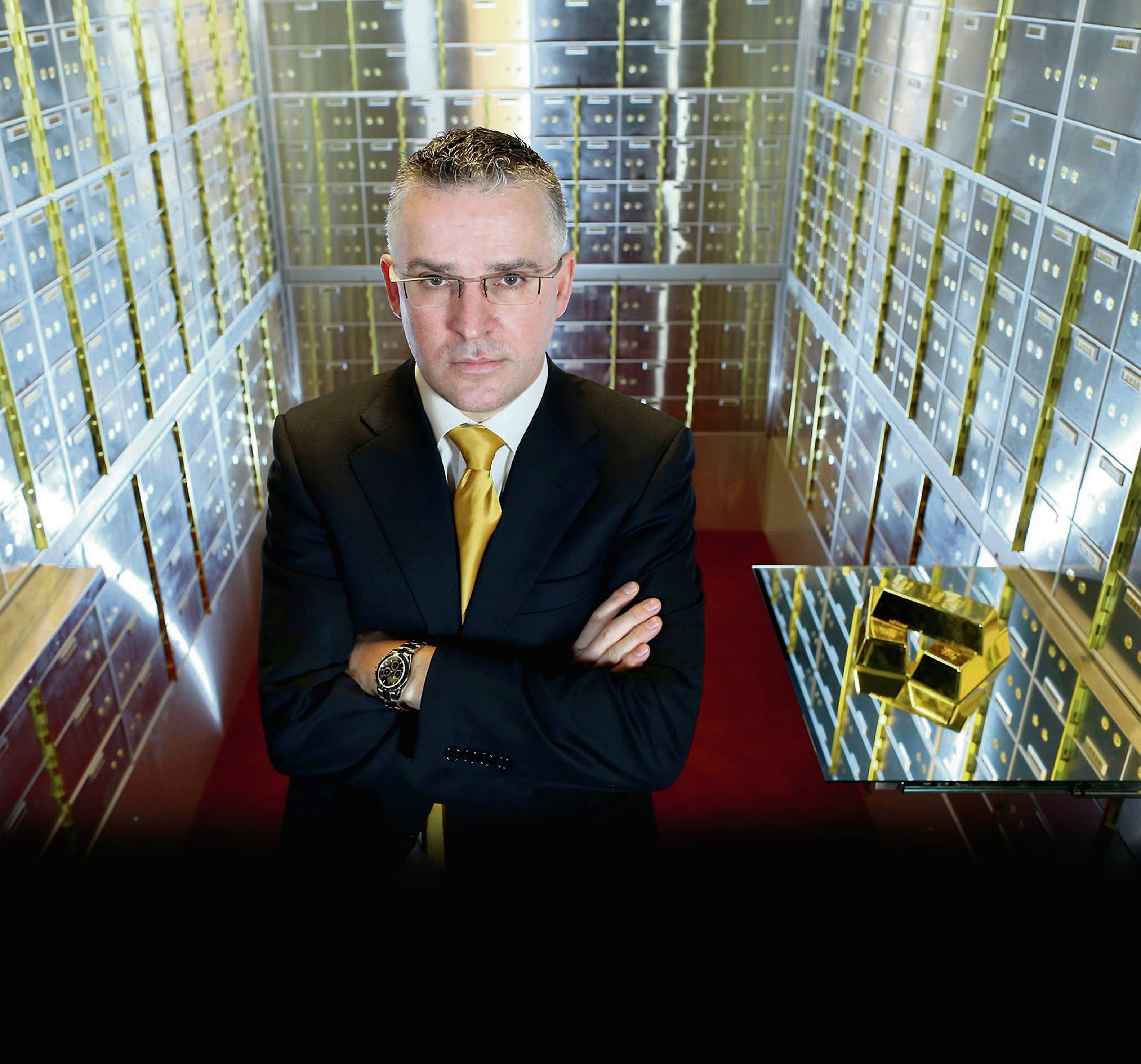

Co-founder Seamus Fahy interviewed on Sky News about Brexit

Seamus Fahy talks to RTE about impact of Brexit on the business

Co-founder Seamus Fahy talks to RTE about impact of Brexit on demand for Safe Deposit

Boxes and Gold Bullion

Impact of Brexit on demand for Safe Deposit Boxes and Gold Bullion

Co-Founder of Merrion Vaults live on UTV discussing impact of Brexit on demand for Safe Deposit Boxes and Gold Bullion. December 2018.

How to Buy and Store Gold Bullion with us

How to buy and store Gold and Silver Bullion in Ireland, Scotland and England with Nigel Doolin, Head of Trading at Merrion Gold & British Bullion

Nigel Doolin is Head of Trading for Merrion Gold in Ireland, Scottish Bullion, Milton Keynes Bullion and Newcastle Bullion in the UK. Having been a long-term personal investor in precious metals and coming from the business background of running a Vault facility, Nigel was involved in the starting-up of Merrion Gold in 2013. Since then the company has grown to include trading desks in Scotland and England. With a keen eye and interest in world economics and politics, Nigel and the team at Merrion Gold have rapidly built up a reputation for straight-talking, transparent dealings and educating investors in what is best for them when purchasing or investing in precious metals.

Where does gold / silver derive its value from?

“The answer to this question stretches back thousands of years! There are Egyptian hieroglyphs from as early as 2600 BC describing gold as a valuable item. Some of the first minted gold coins to be used as currency were found to be from around 600 BC in Asia. The basic reason gold has come to be so valuable must surely derive from the fact that from days past it was an easy way to move around or travel with your wealth. Of course, it could be worn as jewellery, it is hugely resistant to corrosion and it is (relatively) light. Today the world usage and consumption of new gold produced is about 50% in jewellery, 40% in investments, and 10% in industry.

A lot of the above can be said of silver also, except the world usage and consumption figures are quite different with about 60% of silver being used in industry and the remainder in jewellery and investment. A little known fact and probably a good way to put the price of gold and silver into perspective is that there is more Silver mined every DAY than there has EVER been gold mined in the history of records!”

In general, what is the nature of the relationship between the British and Gold/Silver?

We find on the most part the British tend to move towards investing in gold in times of uncertainty – both political and economic. The Lion’s share of investors will look at gold as a medium to long-term investment (4-5 years+), with most happy to ride out the dips that usually come at some stage along the way and wait for their investment to top the price they bought at. We have more and more smaller investors getting interested in buying gold and these would tend to be 1-5oz buyers who will buy coins as opposed to bullion. No matter which of these brackets the buyers fall in to they tend to be more educated on the safe-haven value of gold these days.

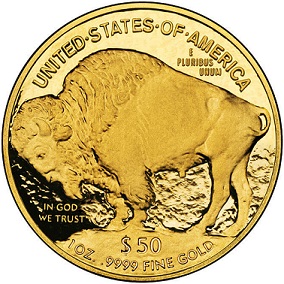

Which is your favourite gold/silver coin and why?

My own personal favourite coin is the 1oz Gold American Buffalo. I think it is one of the most recognisable coins out there and it’s one of the few coins which I like the design on both the front and reverse. It has a great feeling of heritage and nostalgia about it, and I think it very much looks like the kind of coin one would find in a treasure chest of old!

Do you notice any difference in psychology between the silver and gold investor?

In my experience I find gold investors tend to be a little more relaxed in their attitude to their precious metals investments – most are happy to wait out a longer timescale for their investment to mature – silver investors tend to look for a quicker ‘turnaround’ on their investment. I also feel the silver investor would be more willing to take a higher risk.

What are the most common mistakes of physical Gold and physical Silver investors?

I think the most common mistake first-time investors will make is automatically opting to buy coins – we always ask the purpose of the investment so as to be able to give the best precious metals advice to the client. Clients should understand that with coins there are minting charges and you must also take into account that some coins are more in-demand than others, therefore it is possible that someone purchasing a 1oz gold coin could end up paying a lot more for that 1oz coin than they would a 1oz bullion bar. When they go to sell back to a bullion dealer it will almost always be just valued on the weight, therefore (unless you sell a coin to a coin collector) you will rarely make this difference in price back when you go to sell. There are other pitfalls involved when purchasing gold for the first time, which is why at Merrion Gold we strive to educate our clients as well as serving them in the most efficient manner possible.

Are there any tax advantages in Ireland when investing in Gold or Silver?

The most obvious is that gold is VAT Free, whereas there is VAT applied to all silver sales.

In your experience which silver/gold coin is the most difficult to fake?

The most difficult coins to fake are the newer coins – the likes of the 2017 Britannia and the Canadian Maple (from 2015 on) – these coins have laser-precision waves on the face of them which are practically impossible to fake. It must be noted however that no coin is completely impossible to fake – this is why here at Merrion Gold we have a 6-level testing set-up in-house. Buyers should always be wary of any dealer who does not have sufficient testing set-ups in their business.

Can you describe your 6-level testing set-up?

At Merrion Gold, we have a 6-level testing set-up at our disposal in-house. This enables us to test every precious metal that comes through our company, when either buying or selling. Even though we only trade in LBMA approved refineries, this testing ability means we can ensure all precious metals through our company are 100% as they should be. It is worth noting that some companies will use 1 or 2 methods of testing (some listed below), but we find when all of the testing variations below are used together, the result is as definite as you can get.

Our testing set-up includes:

- Digital Weighing scales

- Digital Caliper and dimension matching

- Magnetic Balance Weighing – this measures the (apparent) weight change in the metal by use of a super-strong test magnet positioned on a digital balance.

- Electronic Conductivity measuring apparatus

- Fisch testing implements (for coins and used only in-conjunction with the above)

- Use of Bullion code matching system.

Can you briefly describe the History of Merrion?

Nigel Doolin

When we started Merrion Gold in 2013, we wanted to create a world-class gold bullion and coin trading service. We offer our clients the complete privacy and security they deserve, this is why we are housed within an actual vault facility. This not only offers clients an environment with total security – but we also offer them the ability to purchase, collect and store their precious metals in the one place.

Our trading volumes have increased year on year, proving to us that if you offer the right service and value to clients they will return time and again. In 2016 we opened our second trading desk in Scotland called Scottish Bullion – and in January of 2017 we opened Newcastle Bullion in the UK.

Can you tell us more about the services you offer?

We buy and sell physical gold bullion and coins. We only deal with LBMA approved refineries so our clients can be sure that all gold we sell is ‘good-delivery’ gold. We also have a 6-level testing set-up at Merrion Gold, where all gold moving through us (in OR out) is fully tested and verified. We do not offer any financial advice as we are not QFA’s – however we will give you the very best precious metals advice that you can get.

We also offer safe deposit box rental within the vault (through our sister-companies Merrion/Glasgow/Newcastle/Milton Keynes Vaults) where you can store your precious metals and/or any other valuables you may have.

Why do customers choose Merrion?

I think customers chose Merrion because we are completely transparent and honest in our dealings. The security of being housed within a vault is also a huge plus for us. Our traders have a wealth of knowledge and we try to educate new clients as to what is the best product/s to suit their requirements. Some clients who have given us reviews and feedback online always state that our professionalism and efficiency is second to none. We enjoy what we do here at Merrion Gold and this obviously comes through in our dealings with clients.

Do you sell gold outside the UK / EU?

We can transact with any client anywhere around the world – however when you purchase from us you must collect from one of our vaults. We have vaults currently in Ireland, Scotland and England. We do not ship to anywhere except to our vaults. If the client cannot make it straightaway for their gold collection, we will securely hold their purchase for them in our company safe deposit box within our vault for up to 30 days at no extra cost.

What are the storing costs after the first 30 free days?

We can store clients purchases within our company vault box for up to 30 days at no cost to the client, to enable them sufficient time to collect their purchase. After 30 days the cost is capped at €45 per month.

Where can potential customers find more about your services?

Potential customers can call me directly at: +353 (0)1 254 7901 – Nigel Doolin – Head of Trading or you can view our website at: www.merriongold.ie

Originally published here

Merrion Vaults invests £1m (€1.17m) in Newcastle facility

A £1m (€1.17m) investment by the Irish-based Merrion Vaults in Newcastle in the United Kingdom is set to create the city’s first safe deposit facility.

The new facility, which is known as Newcastle Vaults, is owned by Merrion and has been launched in response to major banks withdrawing safety deposit box services.

It follows similar initiatives by Merrion in Dublin and Glasgow.

The company’s Co-founder David Walsh said the move into Newcastle “is part of our ambitious plans for further growth across the UK.

“We’re looking forward to building the business in the city, providing a much-needed service that will ultimately give peace of mind to people who require a safe haven for their valuable and irreplaceable possessions.”

Meanwhile, Co-founder Seamus Fahy, said: “Cost-cutting measures at high street banks means that secure storage is being phased out and so customers who rely on the boxes to keep their treasured items safe are now left with having nowhere to store them.”

Based in the centre of Newcastle, and with capacity for 15,000 boxes, it offers safe-keeping services to private individuals and businesses, allowing them to safeguard items such as cash, jewellery, family heirlooms, title deeds, and gold bullion.

The state-of-the-art purpose built vault includes surveillance technology such as seismic shock sensors, round-the-clock monitoring, and biometric identification technology.

Which is Better…. A Home Safe or a Safe Deposit Box?

If you have valuables or irreplaceable items you need to keep safe and secure, what is the best option for you? Whether it’s cash, jewellery, gold bullion or just important paperwork you need to keep safe, there are a number of things you should consider when deciding between a home safe or a safe deposit box.

1. A Safe Deposit Box is better value. A small, mid-range home safe will cost approx. £1,000-£1,500 (before fitting costs) – whereas a safe deposit box starts at only £150 per year – giving you over 5 years total safety and security, with 7 day access for less than the cost of the home safe.

2. A Safe Deposit Box will offer better protection from fire. The aforementioned home safe would have a fire rating of Grade 1, this will only offer protection from fire for 30 minutes whereas the safe deposit box in this instance is in a Grade 8 vault, offering a hugely increased fire and security rating.

3. A Safe Deposit box offers much more protection from thieves. People believe they can ‘hide’ their home safe from thieves and burglars. The latest research and expertise from the police proves this is rarely the case. Burglars are now breaking into homes complete with handheld metal detectors (easily available to buy online) – they can then ‘sweep’ the entire property in 5-10mins and will almost always find the ‘hidden’ safe. Thieves will then cause major destruction to property in removing these home safes. It is also worth bearing in mind that if they cannot remove the safe, they may then wait until such time as the homeowner or family is actually in the home, to return and under use or threat of violence make the homeowner comply with their demands to open the safe.

4. Home Safes are notoriously easy to ‘crack’ open. All one has to do is watch an episode of ‘Storage Wars’ on TV, or many other similar TV shows, to see just how easy it is to open a home safe. Alternatively, a quick google search of ‘how to crack a home safe’ returns findings of over 7 million results! (a lot with videos). Safe Deposit Boxes however, are housed within a secure vault, which is practically impossible to open.

5. You can save money on home insurance with the use of a Safe Deposit Box. If you have a home safe, your valuables will still be included in your home insurance – which means you will still be paying for their cover – especially if they are ‘specified items’. When you rent a safe deposit box you can remove these ‘specified items’ from your home insurance policy therefore lowering your premium.

While there are many more advantages to having a safe deposit box over a home safe, it is worth pointing out that any additional security measures you take with your valuables at home will normally be justified. For more information on renting your own private safe deposit box contact [email protected] or call: Call: 0115 857 2640

Safe deposit box provider locks down Glasgow deal

What is being billed as “Scotland’s first independent safe deposit box service” has been launched following an investment of more than £1 million.

Glasgow Vaults said it had made the move in response to the major banks withdrawing the service that safeguards people’s valuable possessions

The venture is being led by David Walsh and Seamus Fahy, who have invested in equipping the vault with state-of-the-art surveillance technology, including seismic shock sensors, making a Hatton Garden-style heist impossible, it has been claimed.

Employing five staff, the Glasgow facility is part of a strategy to expand the model across the UK and Ireland, following the successful launch of an initial site in Dublin, in 2013. The business is expected to grow its staff numbers in Glasgow to 15 by the middle of 2017.

Fahy said: “We identified Scotland as a key growth region, mainly due to the fact that the banks no longer offer the service.”

Stash the cash: Keep your money and valuables safe

Keeping valuables at home is an open invitation to burglars, so why not keep them in a secure vault. asks Mark Keenan.

A wealthy Dublin-based entrepreneur is heading off to see a hypnotist this week – to help him remember where he stashed a wad of tens of thousands of euro he had hidden in a “safe place” in his house.

Having hidden away several stacks of cash for a rainy day, he recently went to retrieve them and discovered he couldn’t account for that last hiding hole.

Household stash mishaps are becoming far more common among the super rich.

Last year the gardai recovered more than 200 grand concealed in the former home of developer Tom McFeely on Ailesbury Road in Dublin 4 (Mr McFeely has denied it is his). Whoever put it there, had certainly hidden it away, believing it to be safe.

Then there was the case of the Barnardos curtains in highbrow Dublin 6. Charity shop staff discovered thousands of euro sewn into a pair of curtains donated by a resident in the area. The money was returned to the embarrassed owner after the shop issued an appeal through the gardai.

Merrion Vaults launches Fine Art & Antique Storage (Walk-in Vaults)

When we launched our Safe Deposit Box business in Dublin, we provided various sized Safe Deposit Boxes capable of storing cash, jewellery, title deeds, gold bullion etc.

We quickly realised that there was also strong demand for larger secure vaults capable of storing Fine Art, Antiques etc. On a daily basis, we were receiving enquiries for larger storage units. We then contacted a number of Art and Antique Dealers and Galleries in Ireland who confirmed that such a service would be invaluable both to the themselves and to their customers.

We also contacted several Safe Deposit Box facilities in the UK to assess demand there. Harrods Safe Deposit Boxes in London confirmed to us that there was a waiting list of 4 years for their walk-in vaults. Typical clients were storing fine art, large antique furniture and gold / silver bullion in their larger vaults.

Milton Keynes Vaults now offers this service to its customers.

Safe Deposit Facility For The Digital Currency (BitCoin)

Bitvendo, the company that provides Bitcoin ATM facilities here, has formed a partnership with Merrion Vaults to provide a safe deposit facility for the digital currency.

Bitvendo, the company that provides Bitcoin ATM facilities here, has formed a partnership with Merrion Vaults to provide a safe deposit facility for the digital currency.

Giles Byrne, head of marketing with Bitvendo, said Merrion Vaults was a natural partner for the group as there was a demand from holders of Bitcoin for somewhere to store their digital currency safely. “We have encrypted wallets inside the vaults. If you want to send bitcoin into those wallets, they are stored offline in an encrypted format where nobody can hack them.”